Choosing a debt payment method

Starting a debt free journey can be overwhelming, especially when you have quite a mountain of debt to climb over. Having a debt payoff strategy is a great way to get started, be organised and stay on track. A debt payment plan helps you see the progress you are making on your journey to keep you motivated and focused on the prize.

There are two main plans to help pay off debt quickly: the debt avalanche method and the debt snowball method. There is usually a debate between which of the two methods is the best to pay off debt faster. I think the best way to get the most out of a debt payment plan is to consider other factors that may apply to your specific situation. Such as how easily motivated you are, how well you are keeping up with your current payments, how tight your current budget is.

Key Points

- The debt avalanche method prioritises paying debts with the highest interest first.

- The debt snowball method prioritises paying debts with the smallest outstanding balance first.

- Both methods require you to focus on making extra payment to one debt at a time while maintaining the minimum payments for all the others.

- The debt avalanche and debt snowball are both effective ways for paying off debt; there are a lot of success stories for both.

- The most important factor in a debt payment plan is YOU! Your decision and commitment to pay off your debts is the single most powerful tool needed to succeed.

Make a list all your debts

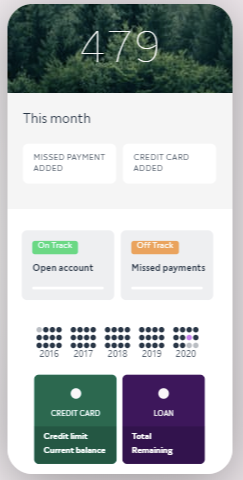

The starting point for either the snowball method or the avalanche is to track and list all your debts. If you are not sure about all the debts you owe, Clearscore can be a good place to start. You can create a FREE account which gives you access to all the credit accounts that are linked to your name. This includes free access to the necessary details (borrowings, credit balance and payment history) you need to track and monitor your debts. You also get a free monthly update on your credit score.

The Debt Avalanche Method

The debt avalanche is sometimes known as the debt stacking method. This method of debt payment recommends that you make a list of all your debts starting with the one with the most interest first and the smallest interest last.

You then tackle the debt with the highest interest first by making a minimum payment on all your other debts and making extra payments on the one with the highest interest. In the example below, that means you make minimum payments to all your debts and extra payments to the personal loan because it has the highest interest of all your outstanding debts. Once the personal loan is paid off, you can move on to the next highest interest, which will be the Credit Card 1.

| Debt | Amount Left | Minimum Payment | APR |

| Personal Loan | £3,500 | £180 | 37.9% |

| Credit Card 1 | £600 | £25 | 24.4% |

| Credit Card 2 | £2,700 | £70 | 18.8% |

| Car Loan | £7,800 | £150 | 9.9% |

Using the debt avalanche method in the example, you will maintain the minimum payments for credit card 1, credit card 2 and car loan. You will then aim to pay £180 for the personal loan plus extra every month to help clear that debt faster. Assuming you free up an extra £150 in you budget to go towards extra debt payment. You will add this to the standard payment of £180 which will increase the Personal Loan to £330 a month. After the personal loan is cleared, you will roll over the £330 you were using to service that loan, to the minimum payment of £25 you were making for Credit Card 1. This means you will now be paying £355 a month towards Credit Card 1.

You follow this pattern until you clear all your debts.

| Debt | Amount Left | Minimum Payment | Extra Payment | New Payment | Status |

| Personal Loan | £3,500 | £180 | £150 | £330 | Paid Off |

| Credit Card 1 | £600 | £25 | £330 (after personal loan paid off) | £355 | Paid Off |

| Credit Card 2 | £2,700 | £70 | £355 (after credit card 1 paid off) | £425 | Paid Off |

| Car Loan | £7,800 | £150 | 9.9% (after credit card 2 paid off) | 575 |

Advantage of the using the avalanche method

The debt avalanche method reduces the amount of money you spend on interest payments overall. Mathematically, it can help save the most money on debt over time.

Disadvantage of using the avalanche method

This method of debt payment requires a lot more motivation as it could be a while before you are able to close a debt account, depending on the outstanding balance.

For example, assuming you can make an extra £150 available in your budget to put on extra debt payment with the example figures. If you were paying the smallest amount first, you could close your credit card 1 debt account within 4 months. Whereas it will take almost a year to pay off the personal loan with the same £150 extra payment a month.

The Debt Snowball Method

As with the avalanche method, the debt snowball also requires you to list all your debts and prioritise paying off one at a time. The difference, however, is the order of the debt listing. The snowball method recommends that you list your debts from the smallest amount to the largest.

| Debt | Amount | APR |

| Visa Credit Card | £600 | 24.4% |

| Mastercard Credit Card | £2,700 | 18.8% |

| Personal Loan | £3,500 | 37.9% |

| Car Loan | £7,800 | 9.9% |

Advantage of using the snowball method

It builds motivation and confidence through quick wins. Mentally, this method is a big cheer on.

Disadvantage of using the snowball method

You may spend more money in interest payments over the course of your debt free journey.

Next steps

You need to make a comprehensive list of all your debts, the amount left on them and the interest to help you determine which method you want to go with. Depending you on circumstance, you might find it beneficial to mix things up.

For example, when we first started, we had a credit card with a very high interest rate (39.9%), and a balance of £3,500 and another credit card with 18.9% interest and a balance of £3,200. We decided to tackle the credit card with 39.9% interest rate first as the interests and monthly repayments took so much out of our budget. Even though the other credit card had a smaller balance, the difference in the interests was far more significant than the difference in the balances.

It is not always the case of ‘either’, ‘or’. In some cases, you need to examine your situation, consider your goals and work towards your financial freedom accordingly. It is what puts the personal in personal finance 😊.